Isabel Almeida of BES (http://www.eurocatalyst.com/2003_bio_von_almeidai.php)

Follow the Portuguese Jornal Expresso (always near the power centres) in it edition of August 2, 2014 Isabel Almeida the Head of Financial Markets Department of Banco Espírito Santo, SA (BES), explain to the new Executive Commission how was possible clients of the bank (BES) financing the Group (Grupo Espírito Santo - GES) and crying, said the journalists Pedro Santos Guerreiro and Sónia M. Lourenço from them sources.

She answer to Amílcar Morais Pires former member of the Administration, linked to the leader Ricardo Salgado and was appointed by the family Espírito Santo as successor of the leader in June follow the media, with Isabel Almeida and Rita Barosa as members of administration.

That solution fall by the pressure of the heavy events and now we see so much troubles in BES and GES.

We hope that persons like Isabel Almeida are not used as scapegoating of a family that have the possibility of manipulate M€ with an incredible sleeping of supervision authorities and we don´t know how much money of imparities are in the black side of the Moon, controled by family.

The crazy financing of GES only was possible in an Europe and a World that don´t do a deep reform of it financial and fiscal system with the leaders and culture still the same (off shores must have a control, big fortunes that win with the drivers of crisis must pay for that, supervision and leading of European Institutions can´t have persons from banks like curriculum vitae with Goldman Sachs et cetera), responsable for the great crisis that we live at the moment with all pressure over the middle and lower classes of revenue and patrimony that support strong and incresead tax burden for financing the empolated expenses of states and the disters of financial system.

Democratic societies must change these trends that created deep vicious circles in the countries with more vulnerabilities like Portugal.

We hope that persons like Isabel Almeida are not victims of badly leaders ...

The Portuguese government go always by the bad sides: a man of Goldman was proposed for European Commission by PSD (Partido Social Democrata) that have with CDS/PP only 27,7% of the votes (909.442 persons only). Partido Socialista (PS) have 31,4% (1.032.252) in a total of only 3.281.856 votes.

EPP S&D ALDE Greens/EFA

ECR GUE/NGL EFD NI

http://en.wikipedia.org/wiki/European_Parliament_election,_2014

So PSD want the same kind of subservience of a financial system of loser games: all will lose in the long term with a more vulnerable Europe

Goldman Sachs reduced it position in the share capital of the holdings of BES to 1,91%, so turned hiden it position (below 2%) before the big crash of stock quotes after the communication of first half of 2014 results: -3.577 M€ of losses, 4,253 M€ of imparities and contigencies. Rating of DBRS downgraded from BBB to BB.

http://web3.cmvm.pt/sdi2004/emitentes/docs/FR51595.pdf

Golman Sachs dossier:

http://www.bloomberg.com/quote/GS:US/chart

http://www.independent.co.uk/incoming/article6264098.ece/alternates/w620/Pg-12-eurozone-graphic.jpg

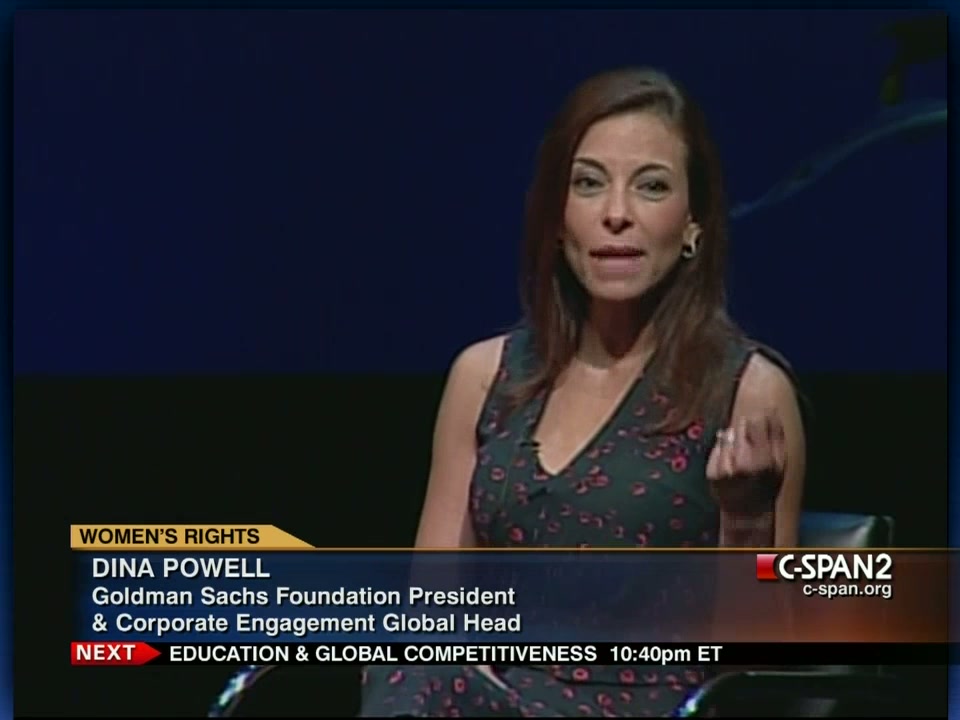

Dina Powell, a Woman in Goldman

Sem comentários:

Enviar um comentário

Muito obrigado pelo seu comentário! Tibi gratiās maximās agō enim commentarium! Thank you very much for your comment!