«Natural petroleum spring in Korňa, Slovakia» - Branork (http://en.wikipedia.org/wiki/Petroleum#mediaviewer/File:Kor%C5%88ansk%C3%BD_ropn%C3%BD_prame%C5%88.JPG)

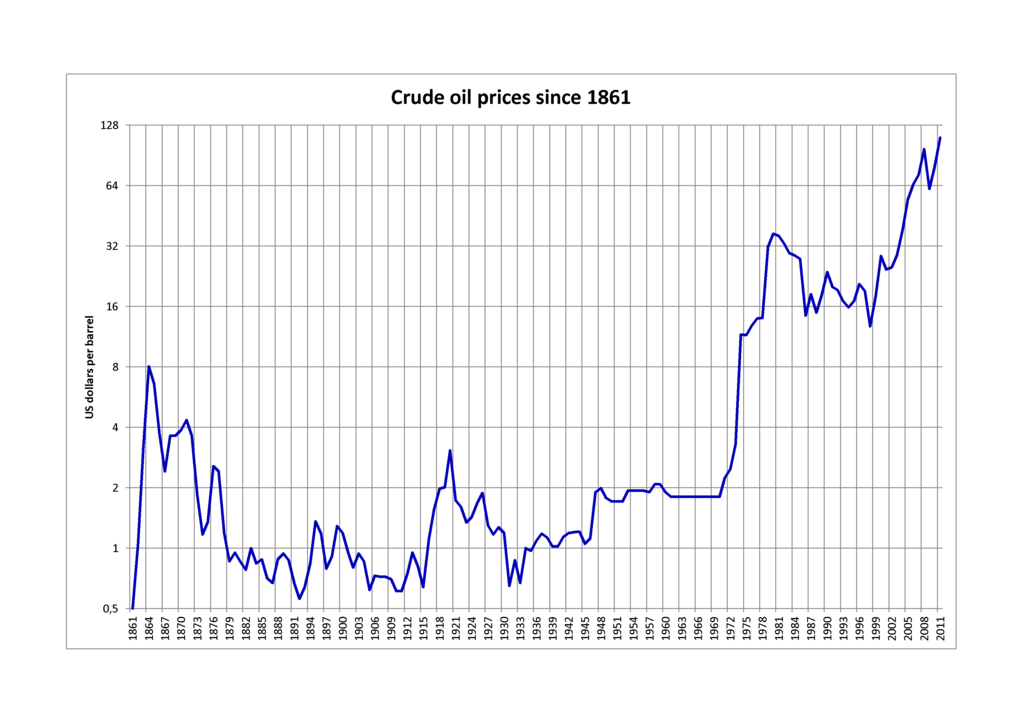

http://en.wikipedia.org/wiki/Price_of_oil#mediaviewer/File:Crude_oil_prices_since_1861_%28log%29.png

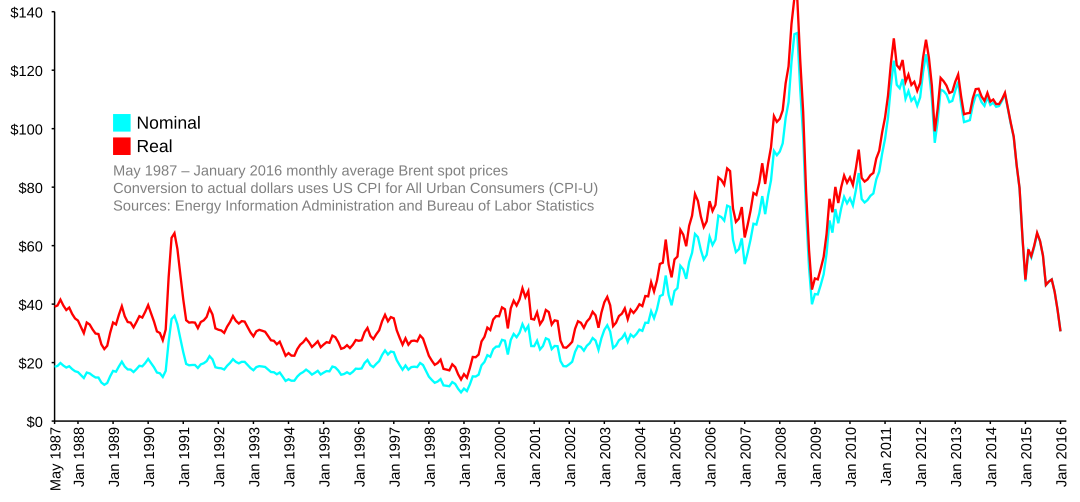

http://upload.wikimedia.org/wikipedia/commons/thumb/0/0f/Brent_Spot_monthly.svg/1080px-Brent_Spot_monthly.svg.png

The Saudi Arabian oil minister, Ali al-Naimi said in December, 2014:

«Why should I cut production? (…) This is a market and I’m selling in a market. Why should I cut? (...)

In a situation like this, it is difficult, if not impossible, for the kingdom or for OPEC to take any action that would reduce its market share and increase the shares of others, at a time when it is difficult to control prices (...) We would lose on both market share and price.»

«If they want to cut production they are welcome: We are not going to cut, certainly Saudi Arabia is not going to cut.»

«As a policy for OPEC, and I convinced OPEC of this, even Mr al-Badri (the OPEC secretary general) is now convinced, it is not in the interest of OPEC producers to cut their production, whatever the price is (...).

Whether it goes down to $20, $40, $50, $60, it is irrelevant (...)»

Costs for Producing Crude Oil and Natural Gas, 2007–2009

2009 Dollars per Barrel of Oil Equivalent1

| Lifting Costs | Finding Costs | Total Upstream Costs | |

| United States – Average | $12.18 | $21.58 | $33.76 |

| On-shore | $12.73 | $18.65 | $31.38 |

| Off-shore | $10.09 | $41.51 | $51.60 |

| All Other Countries – Average | $9.95 | $15.13 | $25.08 |

| Canada | $12.69 | $12.07 | $24.76 |

| Africa | $10.31 | $35.01 | $45.32 |

| Middle East | $9.89 | $6.99 | $16.88 |

| Central & South America | $6.21 | $20.43 | $26.64 |

15,618 cubic feet of natural gas equivalent to one barrel.

http://www.eia.gov/tools/faqs/faq.cfm?id=367&t=8

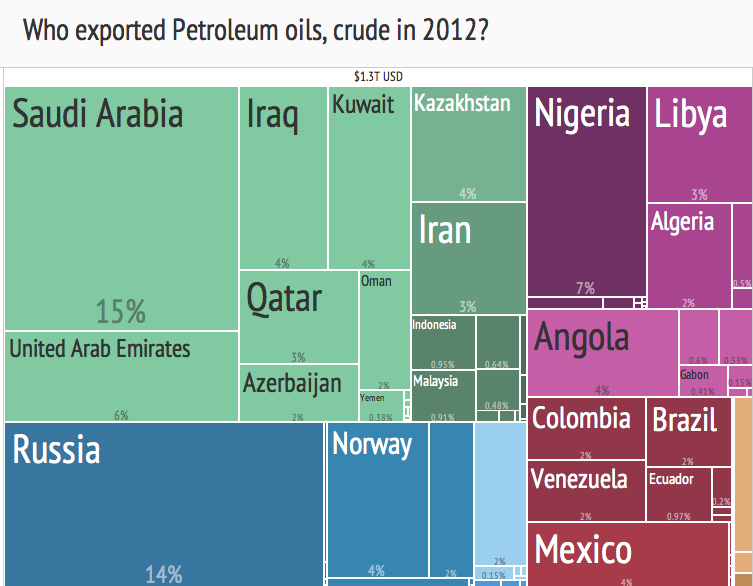

Exports

http://en.wikipedia.org/wiki/Petroleum#mediaviewer/File:2012_Crude_Oil_Export_Treemap.png

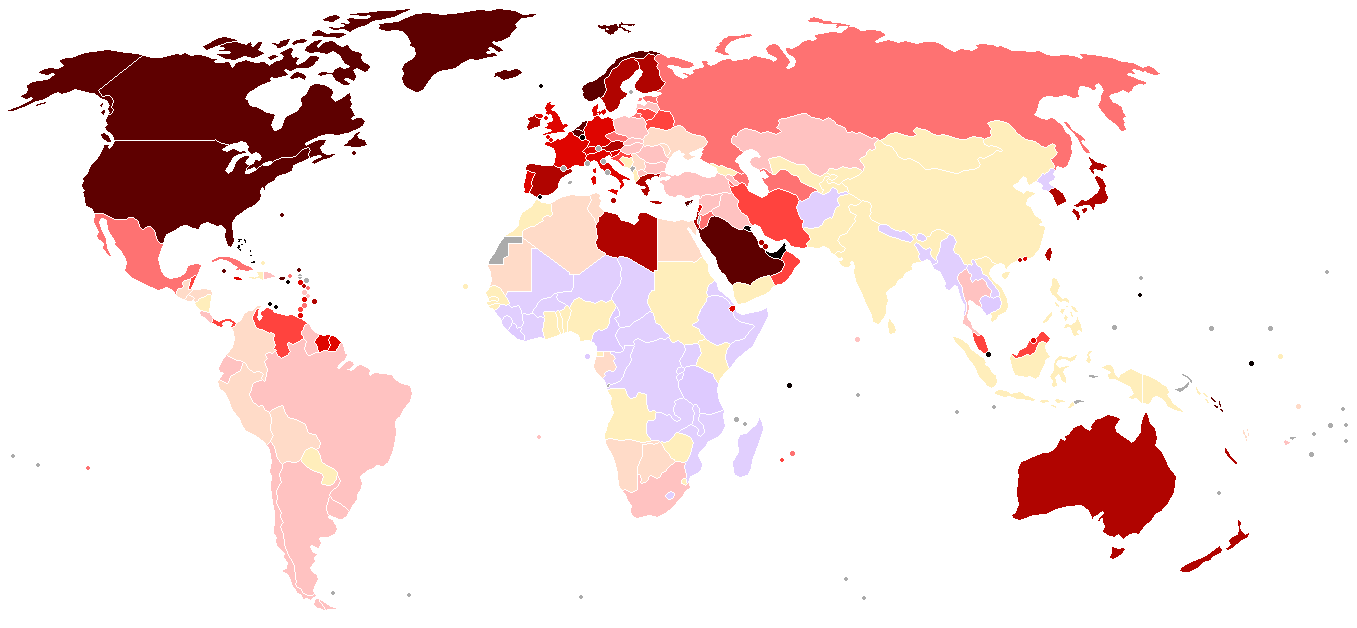

Production

http://en.wikipedia.org/wiki/Petroleum#mediaviewer/File:Oil_producing_countries_map.png

Consumption

http://upload.wikimedia.org/wikipedia/commons/9/9a/OilConsumptionpercapita.png

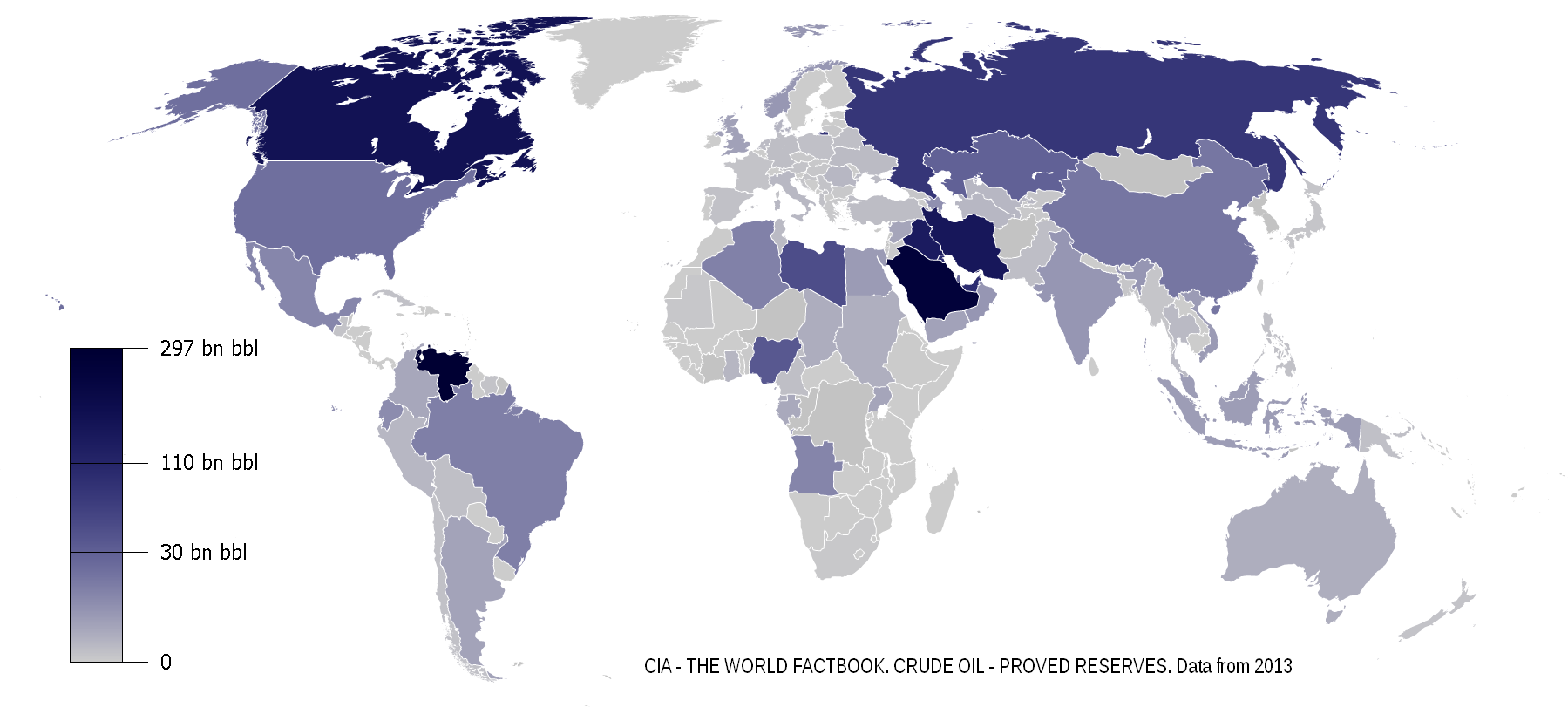

Reserves

http://upload.wikimedia.org/wikipedia/commons/e/e3/Oil_Reserves.png

Sem comentários:

Enviar um comentário

Muito obrigado pelo seu comentário! Tibi gratiās maximās agō enim commentarium! Thank you very much for your comment!