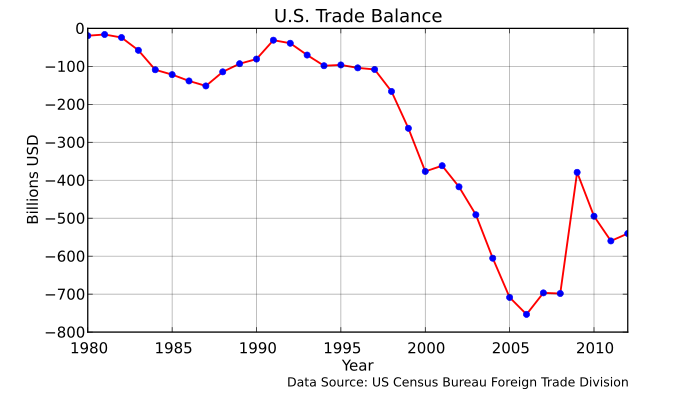

«United States Balance of Trade, 1980–2012, based on February 2013 data. Data Source: US Census Bureau Foreign Trade Division» Morn (Wikipedia)

Republicans, divided, stop them blackmail over social protection using them power in Congress over debt limit. The irresponsability have consequences: the confidence about Federal debt, the escape of USA bonds by China, for example, much more important than agencies ratings.

Paul Krugman with him superficial manipulation of macroeconomic variables said in New York Times (http://krugman.blogs.nytimes.com/2013/10/18/the-china-debt-syndrome/?smid=tw-NytimesKrugman&seid=auto&_r=0):

«wouldn’t China selling our bonds send interest rates up and depress the U.S. economy? (...) have yet to see any coherent explanation of how it’s supposed to work.

Think about it: China selling our bonds wouldn’t drive up short-term interest rates, which are set by the Fed. It’s not clear why it would drive up long-term rates, either, since these mainly reflect expected short-term rates. And even if Chinese sales somehow put a squeeze on longer maturities, the Fed could just engage in more quantitative easing and buy those bonds up.

It’s true that China could, possibly, depress the value of the dollar. But that would be good for America! Think about Abenomics in Japan: its biggest success so far has been driving down the value of the yen, helping Japanese exporters.

But, you say, Greece. Well, Greece doesn’t have its own currency or monetary policy; capital flight there led to a fall in the money supply, which wouldn’t happen here.»

If Federation would lost external financing that will not good for USA! Create money without external financing of trade balance deficit and Federal deficit is not sustentable. The devaluation of dolar could be danger. We have a reality with much more variables than macroeconomic models! Be careful keynesians and liberals! You are ignorants and dangerous! The reality show clearly your errors in World! We need a more complex point oof view, we must change World regulation!

Christine Lagarde, IMF General Director (Reuters/Mike Theiler)

«Na sua opinião, o que será necessário para os Estados Unidos recuperarem a sua competitividade?Para

mim, a competitividade é conferida pelo preço ou pela qualidade – e,

com isso, refiro-me a uma mistura adequada de tecnologia, invenção e

marcas. Uma coisa que poderia ajudar seria a inovação continuada, uma

área que foi extremamente benéfica para a competitividade dos Estados

Unidos. O meu conselho é nunca desistir da educação e nunca desistir do

desenvolvimento científico, porque é daí que deriva muita produtividade e

competitividade.

Sem comentários:

Enviar um comentário

Muito obrigado pelo seu comentário! Tibi gratiās maximās agō enim commentarium! Thank you very much for your comment!